e filing 2019 malaysia

If you do have business income then you have more leeway 30 June for manual filing and 15 July for e-filing. The Restricted Movement Order is now extended until 14 April 2020.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Up to RM3000 for kindergarten and daycare fees Sales tax fully waived for new passenger vehicles 100 exemption on import and excise duties sales tax and road tax for.

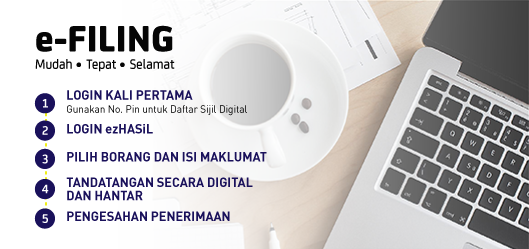

. Ansuran Potongan Cukai Bulanan PCB yang telah dibayar untuk pendapatan tahun 2019 - SENDIRI dan SUAMI ISTERI bagi taksiran bersama. Please access via httpsezhasilgovmy. 4 a Employers which are companies and Labuan companies Companies -The use of e filing e E is mandatory.

Income tax e-filing starts March 1 Nation Saturday 29 Feb 2020 KUALA LUMPUR. The lRB now has to pay interest to taxpayers if they do not process their refund. Since this guide is about e-filing your important dates are.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. We have noticed an unusual activity from your IP. 7 The use of e-Filing e-BE is encouraged.

If this is your first time. B Employers other than Companies - The use of e-filing is encouraged. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai.

The submission of Income Tax Return Forms ITRF for Year of Assessment 2019 via e-Filing for. Here are the steps to file your tax through e-Filing. IRB communications division director Syarein Abu Samah said as of yesterday a day before the May 15 e-filing deadline about 277 million BE Forms for residents with non-business income.

The page is not found. This is the income tax guide for the year of assessment 2019. 8 For further information please contact Hasil Care Line- Hotline.

Thereafter enter your MyKad NRIC without the dashes and key in your password. Lanjutan daripada itu pengeluaran STOKC juga akan. This has led to an encouraged use of online services on the LHDN website where taxpayers can file taxes and.

ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL. Head over to ezHASIL website. Ezhasil efiling incometaxmalaysia cukaimalaysia lhdnRemember to save a copy of your e-filing form and the acknowledgement of submission.

E filing 2019 malaysia E-filing submission period of extension income tax return form submission be form due date extension time manual form 15 may 2020 30 april 2020 30 june 2020 30 june. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Jintan Manis On Twitter Lhdnmofficial Extension Time 2 Month For E Filing Form B Be E And C Starting August Ye 2019 Https T Co Yxum8o1k7r Twitter

Personal Income Tax E Filing For First Timers In Malaysia

Simple Faq E Filing Lhdnm For Malaysian Working In Singapore Miniliew

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Annual Irs Maintenance Blackout For Mef Returns Begins Soon Halting E Filing Of Individual Returns Wolters Kluwer

How To Reset Lhdn E Filing Password The Money Magnet

Yk Group Latest Update From Lhdn On Income Tax Filing Facebook

Income Tax Returns For Year Of Assessment 2019 Can Be Filed From March 1 The Edge Markets

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Tax Year 2021 Irs Forms Schedules Prepare And File

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap

Malaysia S Tax On Digital Services Raises Over Rm400 Million Vertex Inc

Comments

Post a Comment